![]()

1031 DST EXCHANGE SOLUTIONS

A SIMPLIFIED APPROACH TO 1031 EXCHANGE INVESTING

TO CONSULT WITH A 1031 DST ADVISER - COMPLETE THE FORM OR CALL

*1031 Exchange Adviser has strategic partnerships with other experienced professionals such as attorneys, CPAs, real estate and mortgage brokers who can provide advice.

Mortgage Solutions is not affiliated with Global Wealth Management (GWM) or Madison Avenue Securities, LLC (MAS). GWM and MAS does not endorse Mortgage Solutions and there is no obligation to do business with this firm. Mortgage Solutions information is provided for educational benefit.

Net Lease is not affiliated with Global Wealth Management (GWM) or Madison Avenue Securities, LLC (MAS). GWM and MAS does not endorse Net Lease and there is no obligation to do business with this firm. Net Lease information is provided for educational benefit.

An Easier Path to Real Estate Investing: 1031 Delaware Statutory Trusts

AS SEEN IN

![]()

C. Grant Conness - 1031 Exchange Advisers

There are strategies out there that could save you thousands of dollars in taxes, but you probably won't ever hear about them unless you work with an experienced professional.

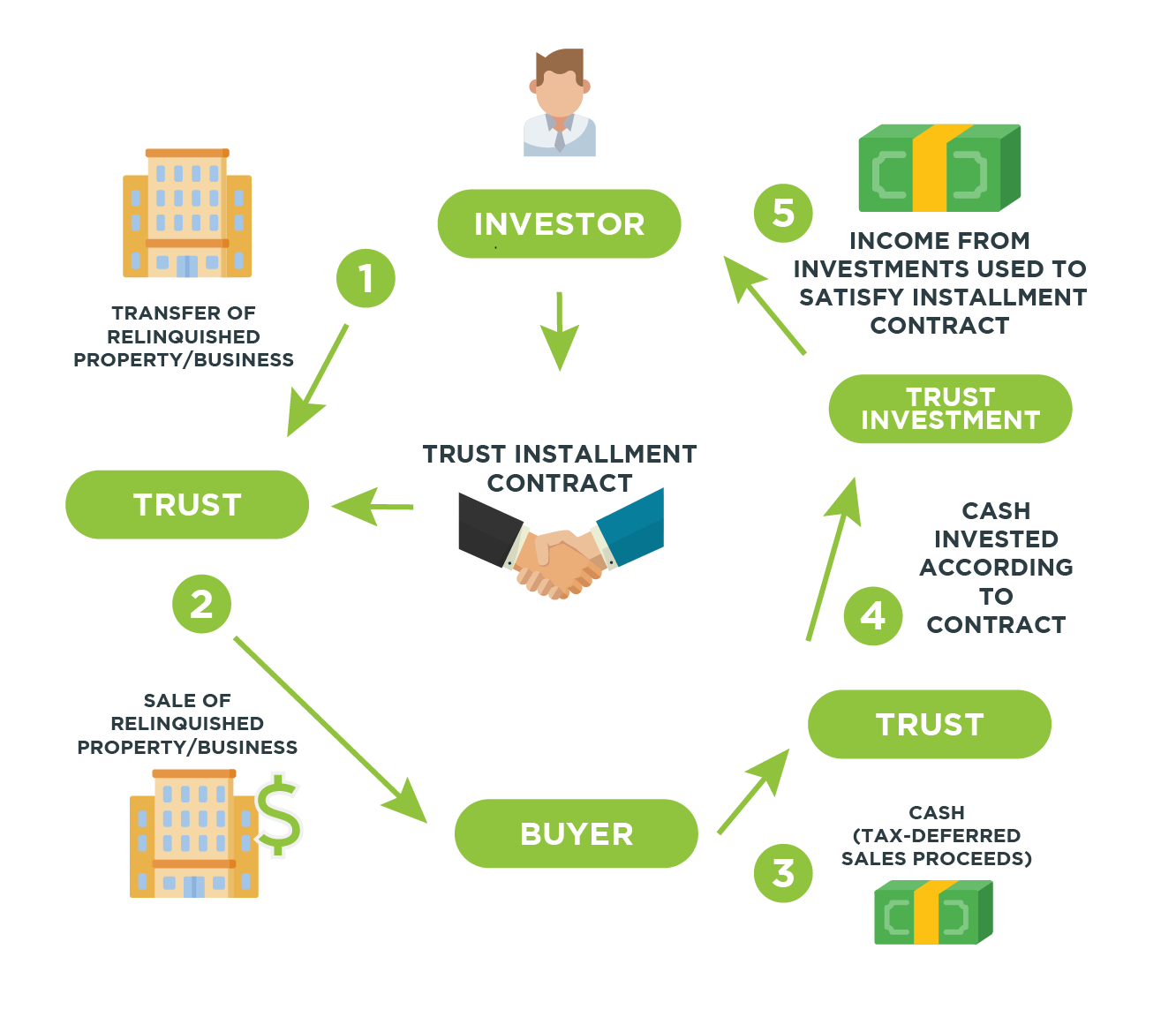

The Deferred Sales Trust is one of those. It isn't well known, but it should be. Here's how it works.

We sometimes have clients who own property for a long time, or a business or some other highly appreciated asset, and they're reluctant to sell because of the thousands, or hundreds of thousands, of dollars they will have to pay in capital gains taxes.

They may know about the 1031 Exchange, an excellent tool that allows you to defer paying capital gains taxes on a sale by reinvesting the proceeds into a replacement property. The problem is, some people just don't want to go back into real estate. That's where the Deferred Sales Trust comes in. By using Section 453 of the Internal Revenue Code, which pertains to installment sales and related tax provisions, it lets people sell a property or business, defer the capital gains tax and roll the money into investments other than just real estate.

So, let's say you were selling a property for $1 million. Instead of selling directly to a buyer, you would draw up an installment contract with a third-party trust with the promise that it would pay you over a predetermined period. You would transfer the property to the trust, and the trust would be allowed to sell it to the buyer. Because you sold to the trust in agreement to be paid overtime, you wouldn't have to pay taxes on the sale until you start receiving those installment payments from the trust. So instead of having $700,000 or $800,000 leftover after taxes, the whole million is there for the trust to reinvest in stocks, bonds, real estate, annuities or any other type of investment that would generate a greater income stream for the trust to pay you under your agreement with the trust.

HOW A 1031 EXCHANGE WORKS

THE DELAWARE STATUTORY TRUST

A Delaware Statutory Trust (DST) is a separate legal entity created as a trust under Delaware statutory law that also qualifies under section 1031 as a tax-deferred exchange. (Rev. Ruling 2004-86) The DST owns 100% of the fee interest in the real estate and permits up to 2,000 investors. Under the DST structure, the lender only needs to make one loan to one borrower, saving both the lender and the investor time and money. The managing trustee of the DST is usually the sponsor or affiliate. This gives the lender greater security knowing that the sponsor will be operating the property.

Source: Deleware, INC https://www.delawareinc.com/blog/what-is-a-delaware-statutory-trust/

TRADITIONAL 1031 VS DST 1031

TRADITIONAL 1031 EXCHANGE

• Difficult to purchase and ID

• Responsible for debt

• Potential closing delays

• 45-day worries

• No diversification

DST 1031 EXCHANGE

• Property already purchased and ID’ed

• Not responsible for debt

• Close in 2-7 days

• No 45-day worries

• Diversification

We are an independent financial services firm helping individuals create retirement strategies using a variety of investment and insurance products to custom suit their needs and objectives.

Securities and investment advisory services can only be solicited in the states where a financial professional is licensed and registered to do business in. Please inquire as to which states the financial professional is licensed and registered in before engaging in a business relationship. Securities offered only by duly registered individuals through Madison Avenue Securities, LLC (MAS), member FINRA/SIPC. Advisory services offered only by duly registered individuals through Global Wealth Management Investment Advisory (GWM), a Registered Investment Advisor. MAS, Global 1031Exchange, and GWM are not affiliated companies.

Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. None of the information contained on this website shall constitute an offer to sell or solicit any offer to buy a security or any insurance product.

*Any references to protection benefits or steady and reliable income streams on this website refer only to fixed insurance products. They do not refer, in any way, to securities or investment advisory products. Annuity guarantees are backed by the financial strength and claims-paying ability of the issuing insurance company. Annuities are insurance products that may be subject to fees, surrender charges and holding periods which vary by insurance company. Annuities are not FDIC insured.

Any media logos and/or trademarks contained herein are the property of their respective owners and no endorsement by those owners of Global Wealth Management or its representatives is stated or implied.

The Society of Financial Awareness "SOFA" is a paid membership organization comprised of professionals of varying specialties. SOFA is a 501(c)(3) non-profit organization whose focus is to provide financial education to individuals, businesses and organizations through member professionals. The SOFA logo and/or trademarks are property of their respective owners and no endorsement of Global Wealth Management or its representatives is stated or implied.

The National Ethics Association (NEA) is a paid membership organization. All NEA Background-Checked members have successfully passed the annual seven-year background checks for criminal, civil, and business violations in order to meet the membership standards. However, the association provides no guaranteed assurance or warranty of the character or competence of its members. Always make financial decisions on the basis of your own due diligence.

The information and opinions contained in any of the material requested from this website are provided by third parties and have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. They are given for informational purposes only and are not a solicitation to buy or sell any of the products mentioned. The information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual's situation.